4500

TRUSTED CLIENTS

98%

SUCCESSFUL CASES

$300,000,000

ASSETS SAVED

2000

LOAN MODIFICATIONS

4500

TRUSTED CLIENTS

98%

SUCCESSFUL CASES

$300,000,000

ASSETS SAVED

2000

LOAN MODIFICATIONS

New Jersey Bankruptcy Attorney

“A new opportunity in life, unhampered by the pressure and discouragement of preexisting debt.”

– Bankruptcy as described by The Supreme Court of the United States

Filing for Bankruptcy in New Jersey

Chapter 7 Bankruptcy

Chapter 7 Personal Bankruptcy

Chapter 7 Business Bankruptcy

Chapter 13 Bankruptcy

If you own a home, to guarantee that it is protected in bankruptcy, a Chapter 13 Bankruptcy is necessary. In Chapter 13 Bankruptcy, you can repay as little as $150.00 per month to your creditors for 36 months. In exchange, you can protect your home and other assets. There are income limits to file for Chapter 7 Bankruptcy. In New Jersey, many individuals and married couples do not qualify for Chapter 7 Bankruptcy based on their household income, and Chapter 13 is the best way for them to reorganize their finances and get out of debt. Chapter 13 Bankruptcy is based in Federal Bankruptcy Law. However, critically, there are local New Jersey Bankruptcy Laws and local practice rules and nuances that determine Chapter 13 eligibility and qualification. Let a skilled bankruptcy attorney walk you through how Chapter 13 works and how it can benefit you. Please don’t jump to conclusions on qualifying for Chapter 13 or Chapter 7 Bankruptcy on your own.

If you own a home, to guarantee that it is protected in bankruptcy, a Chapter 13 Bankruptcy is necessary. In Chapter 13 Bankruptcy, you can repay as little as $150.00 per month to your creditors for 36 months. In exchange, you can protect your home and other assets. There are income limits to file for Chapter 7 Bankruptcy. In New Jersey, many individuals and married couples do not qualify for Chapter 7 Bankruptcy based on their household income, and Chapter 13 is the best way for them to reorganize their finances and get out of debt. Chapter 13 Bankruptcy is based in Federal Bankruptcy Law. However, critically, there are local New Jersey Bankruptcy Laws and local practice rules and nuances that determine Chapter 13 eligibility and qualification. Let a skilled bankruptcy attorney walk you through how Chapter 13 works and how it can benefit you. Please don’t jump to conclusions on qualifying for Chapter 13 or Chapter 7 Bankruptcy on your own.Chapter 11 Bankruptcy

Creditor’s Rights

Foreclosure Defense

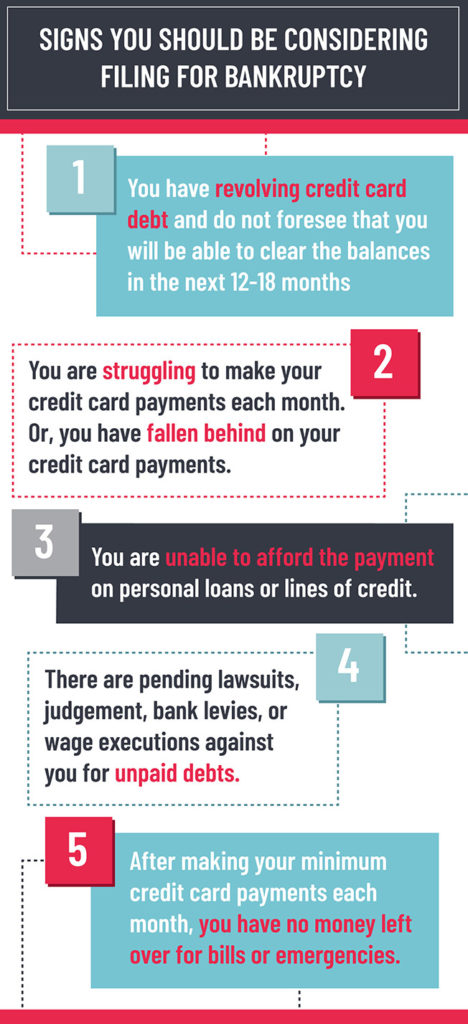

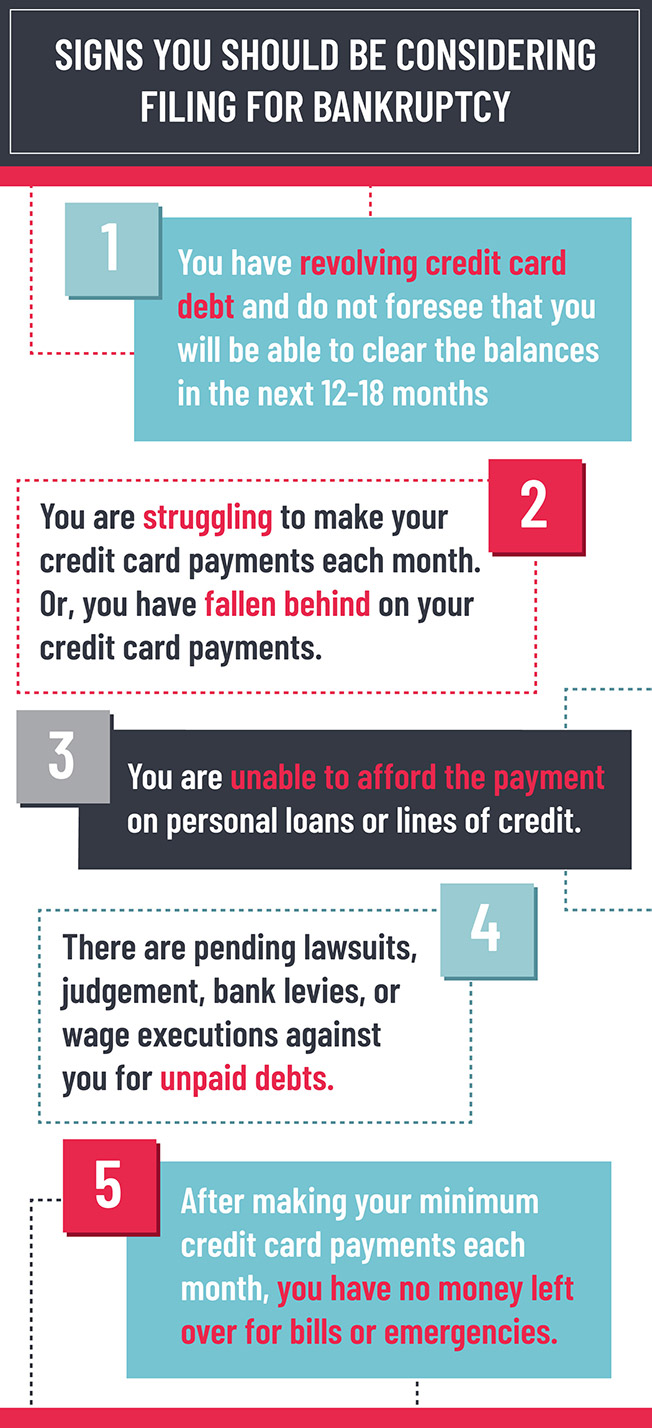

5 Signs You Should Be Considering Filing for Bankruptcy in New Jersey

Bankruptcy can certainly be a nerve-racking subject, but I find all to often that people wait too long until they are completely over their heads and debt and made matters worse than they need to be. If any of these tell-tale signs apply to your situation, please consider your need for a bankruptcy attorney seriously and consult our office right away.

- You have revolving credit card debt and do not foresee that you will be able to clear the balances in the next 12-18 months.

- You are struggling to make your credit card payments each month. Or, you have fallen behind on your credit card payments.

- You are unable to afford the payment on personal loans or lines of credit.

- There are pending lawsuits, judgement, bank levies, or wage executions against you for unpaid debts.

- After making your minimum credit card payments each month, you have no money left over for bills or emergencies.

New Jersey Bankruptcy Attorney

“A new opportunity in life, unhampered by the pressure and discouragement of preexisting debt.”

– Bankruptcy as described by The Supreme Court of the United States

Filing for Bankruptcy in New Jersey

Chapter 7 Bankruptcy

Chapter 7 Personal Bankruptcy

Chapter 7 Business Bankruptcy

Chapter 13 Bankruptcy

Chapter 11 Bankruptcy

Creditor’s Rights

Foreclosure Defense

5 Signs You Should Be Considering Filing for Bankruptcy in New Jersey

Bankruptcy can certainly be a nerve-racking subject, but I find all to often that people wait too long until they are completely over their heads and debt and made matters worse than they need to be. If any of these tell-tale signs apply to your situation, please consider your need for a bankruptcy attorney seriously and consult our office right away.

- You have revolving credit card debt and do not foresee that you will be able to clear the balances in the next 12-18 months.

- You are struggling to make your credit card payments each month. Or, you have fallen behind on your credit card payments.

- You are unable to afford the payment on personal loans or lines of credit.

- There are pending lawsuits, judgement, bank levies, or wage executions against you for unpaid debts.

- After making your minimum credit card payments each month, you have no money left over for bills or emergencies.

Chapter 7

Chapter 7 bankruptcy is a clean slate on your debts. A fresh start unburdened by your prior debts.

Read More

Chapter 13

Chapter 13 bankruptcy is a soft landing for those that need to time to resolve their debts.

Loan Modification

Correctly applying for loan modification greatly improves your chance to qualify.

VIEWS ON BANKRUPTCY FEATURED IN

LATEST NEWS & TESTIMONIALS

Emergency Bankruptcy Filings: When Time Is of the Essence

As a bankruptcy attorney in New Jersey, I frequently encounter situations where individuals face imminent financial crises such as [...]

Why Bankruptcy Could Be the Best Decision You Ever Make

As a bankruptcy attorney, I frequently encounter clients who hesitate to file for bankruptcy because of misconceptions about what [...]

REQUEST A FREE CONSULTATION

Fill out the form below to receive a free and confidential initial consultation. Or call:

732-737-7985